Customize within 9-12th grade subjects

- 7 courses included

- Update grade level anytime

Subscribe more students, save more!

10% off

2 students

20% off

3-5 students

25% off

6+ students

Your high schooler is honing their ability to think critically and analytically. They also might be starting to think about career or college options after graduation, so choosing classes they enjoy and that align with their goals is important.

For high school learners who want to do math at one grade level and language arts at another, Time4Learning offers the ultimate flexibility. It's easy to select subjects across grade levels from ninth grade all the way to twelfth grade.

Parents have the ability to select courses by grade level when they onboard their student after purchasing.

How It Works

- Purchase the curriculum to get started.

- Create your parent account and add your student - we'll guide you through it.

- Customize your child’s learning path: Your student will start in 9th grade by default. You can adjust the grade level for each of the 7 courses (Grades 9–12) to match your child’s needs.

Need to make changes later? You can switch course levels anytime as your child grows or needs extra support.

High School Core Course Options

English:

- English I

- English II

- English III

- English IV

Science:

- Biology

- Chemistry

- Physics

- Introduction to Engineering

- Introduction to Computer Science

Math:

- Algebra I

- Geometry

- Algebra II

- Advanced Math & Trigonometry

- Pre-Calculus

Note: If your student has completed both Algebra II and Geometry, Pre-Calculus is a great choice—especially for those pursuing STEM or wanting to reinforce core math skills for college. If they’ve only completed Algebra II, and prefer a more targeted course, Advanced Math & Trigonometry offers a strong alternative.

Social Studies:

- United States History

- World History

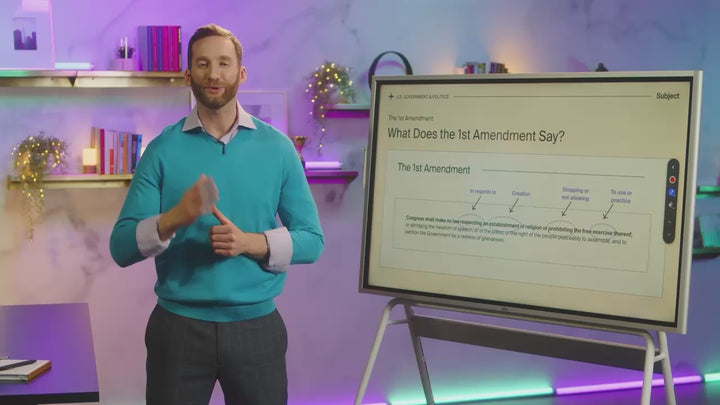

- US Government & Politics

- Economics

High school learners choose from the following elective options:

- Drawing I

- Photography I

- Introduction to Engineering

- Economics

- Health Education

- Physical Education

- Financial Literacy I: Personal Finance

- Financial Literacy II: Budgeting & Investment

- Music Production and Digital Media

- Introduction to Computer Science

- Senior Seminar

It's easy to select courses from ninth grade all the way to twelfth grade.

Ninth Grade Core Course Scope & Sequence Sample:

English I

- Chapter 1: The Human Story

- Chapter 2: Why Do We Read Stories?

- Chapter 3: Making Meaning Through Annotations

- Chapter 4: The Power of Summarizing and Inferring

- Chapter 5: Why Do We Read Informational Texts?

- Chapter 6: Making Meaning with Text Features

- Chapter 7: How Informational Texts Can Change Our Experience with Literature

- Chapter 8: What Actually Is Grammar Anyway?

- Chapter 9: Writing to Communicate Our Insight

- Chapter 10: Writing Original Analysis

- Chapter 11: Personal Narratives: The Autobiography

- Chapter 12: Informational Texts and Autobiographies

- Chapter 13: Wrapping Up The School Days of an Indian Girl

- Chapter 14: What "They Say": Conducting Research

- Chapter 15: They Say/I Say: Forming an Argument of Your Own

- Chapter 16: Outlining

- Chapter 17: Writing the Body of Your Research Paper

- Chapter 18: What “I Say”: Constructing a Research Paper

- Chapter 19: Your Reader’s Best Friends: Intros, Conclusions, and Works Cite

Algebra I

- Chapter 0: Getting Ready for Algebra

- Chapter 1: Introduction to Algebra

- Chapter 2: Solving Equations

- Chapter 3: Linear Functions

- Chapter 4: Graphing Linear Equations

- Chapter 5: Solving and Graphing Inequalities

- Chapter 6: Systems of Equations and Inequalities

- Chapter 7: Exploring Absolute Value Functions

- Chapter 8: Exponents and Radicals

- Chapter 9: Exponential Functions

- Chapter 10: Quadratic Expressions and Equations

- Chapter 11: Quadratic Functions

- Chapter 12: Exploring One-Variable Data

- Chapter 13: Exploring Two-Variable Data

Biology

- Chapter 1: The Foundation of Life

- Chapter 2: Classification and Types of Cells

- Chapter 3: Cell Processes

- Chapter 4: Genetics Part 1

- Chapter 5: Genetics Part 2

- Chapter 6: Evolution Part 1

- Chapter 7: Evolution Part 2

- Chapter 8: Ecology

- Chapter 9: Ecology & Human Impact

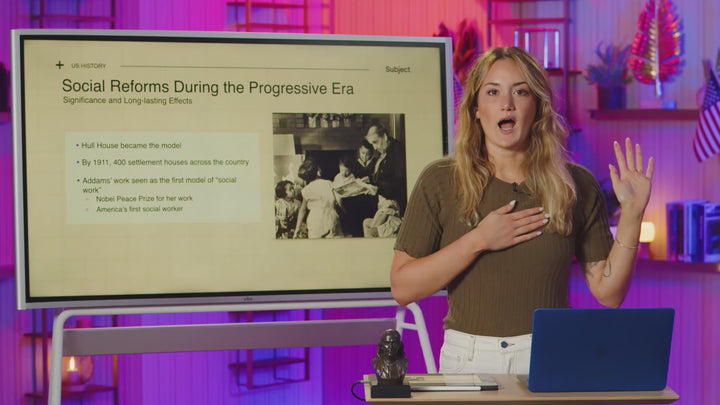

U.S. History

- Chapter 1: The Founding Principles

- Chapter 2: Post Civil War Era

- Chapter 3: The Progressive Era

- Chapter 4: Rise of a World Power

- Chapter 5: Domestic Changes During the 1920s and 1930s

- Chapter 6: World War II

- Chapter 7: The Early Cold War

- Chapter 8: The Civil Rights Movement

- Chapter 9: The 1970s and 1980s

- Chapter 10: The 1990s to Modern Era